Estimated Cost of Attendance

The Estimated Cost of Attendance includes the average costs for a student to attend UC Davis for one academic year, usually listed as nine-month amounts and used to determine aid packages only. The Total Estimated Cost of Attendance is the sum of all budget components, including both direct and indirect costs. Note that special programs and terms, such as summer sessions or graduate/professional degree programs, may have different calendars and therefore different budgets.

- Direct Costs: Charges included in the cost of attendance that the student/family pays directly to the college. Actual charges may vary by student. For example, students may have different housing options or may enroll in a part-time program.

- Indirect Costs: Estimated expenses in the cost of attendance that are not paid directly to the institution.

Estimated Cost of Attendance amounts are subject to change. Each portion of a student's budget is allocated to these categories:

Systemwide Tuition and Fees

Systemwide tuition and fees are a direct cost and include the total amount you are charged for classes, student services fees, and nonresident supplemental tuition (if you are a nonresident), rounded to the nearest dollar. All students pay UC Tuition. Your tuition amount is based on the year you first enrolled in a degree program at UC and on whether you are a California resident or a nonresident. Under the UC Tuition Stability Plan, tuition should remain the same cost each year for up to six years from the time of your first enrollment (barring any unexpected economic changes). For the purposes of assessing cohort-based charges, a student's cohort will be based on the academic year of the term in which a student first enrolls at UC as a degree-seeking undergraduate. For a full breakdown of tuition and fee amounts, please visit the UC Davis Tuition and Fees website.

Campus-based Fees

This is a direct cost. These fees help fund a variety of student-related services, such as student government, student public transportation, building improvements, etc. Campus-based fees are established, increased, or renewed by student vote in campus elections.

Housing and Food (on-campus)

Housing and Food includes housing, food, utilities, telephone, meals, and groceries while attending college, regardless of a student's housing option.

On-Campus Housing

For students with a recognized contract through UC Davis Student Housing and who pay costs quarter by quarter via MyBill, this is a direct cost. For financial aid and budget purposes, the following are considered On-Campus Housing:

- Residence Halls – Segundo, Tercero and Cuarto (quarterly)

- On-Campus Apartments – The Green at West Village (quarterly), Orchard Park (monthly/quarterly), and Primero Grove (monthly)

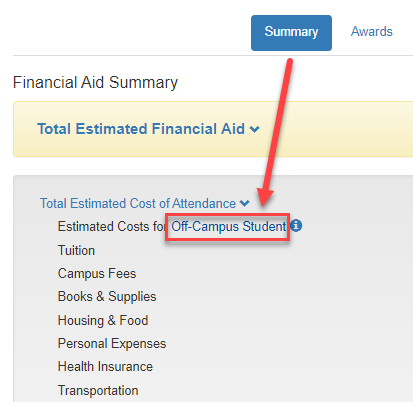

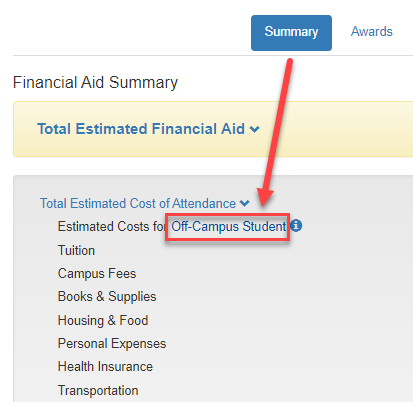

Important: Students should ensure that MyAwards is displaying the correct housing status based on the information provided above. Students can view their housing status on the Summary tab by expanding the Total Estimated Cost of Attendance dropdown.

If a student's housing status is listed incorrectly, they can update Financial Aid and Scholarships with a Housing Status Change submission:

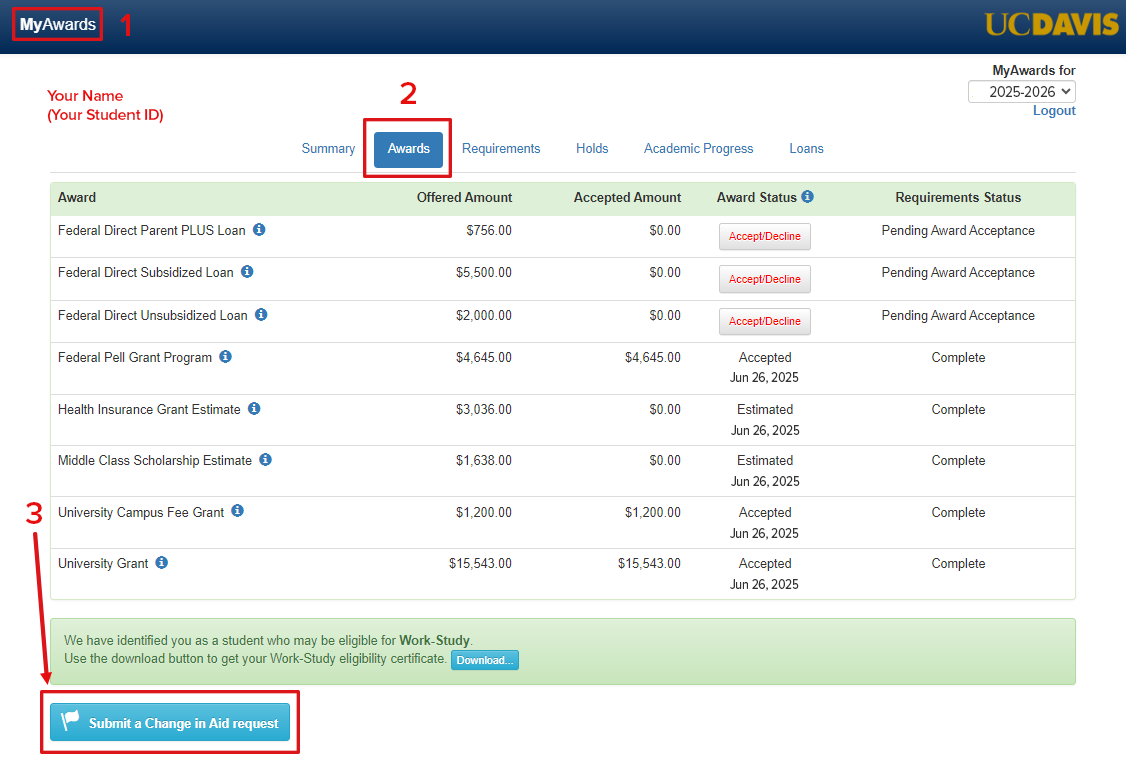

- Log in to MyAwards

- Click on the Awards tab

- Click the Submit Change in Aid request link

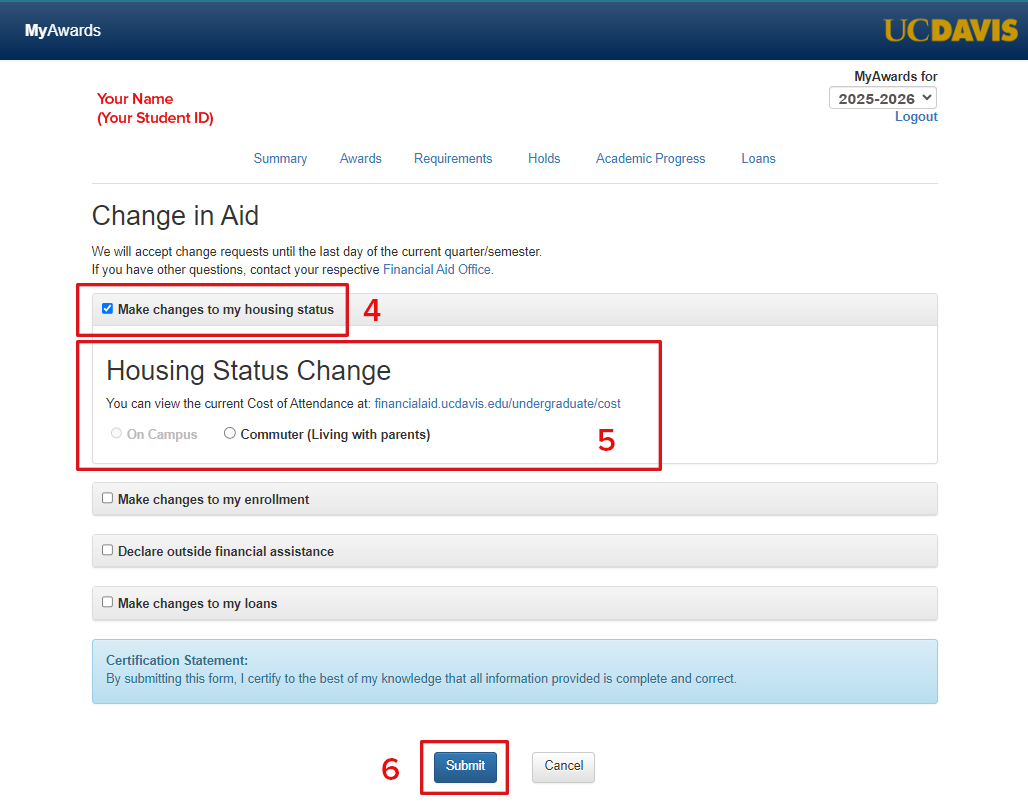

- Select Make changes to my housing status

- Select the correct Housing Status

- Submit

Once submitted, Financial Aid and Scholarships will update the student's budget within 7-10 business days.

Please note: The amount of grants and scholarships awarded are subject to change and may be prorated based on a student’s actual budget type, i.e., residence hall versus an off-campus apartment. Changes to qualifying information or revisions of federal, state, or institutional policy may result in updates to aid eligibility and adjustments of financial aid awards.

Health Insurance Assistance

This is a direct cost, a charge billed to your college student account unless the student applies for and is approved for a waiver. This amount reflects the annual charge for the UC Student Health Insurance Plan (UC SHIP), which covers an academic year.

All enrolled students are required to have health insurance that meets minimum coverage limits established by the University of California. Students are automatically enrolled and the charge is included in the student bill. Students who have adequate private insurance and do not wish to enroll in UC SHIP may request an insurance waiver from the campus Student Health office by the campus’s designated deadline. Students will need to have their private insurance plan information available when submitting the waiver request.

Students will also need to notify their insurance provider about their move to Yolo County.

Financial Aid offers may include a UC Health Insurance Loan or Grant to assist eligible students with this expense. Students who elect to waive UC SHIP fees will not be eligible for UC SHIP gift aid. Please note that your financial aid offer may change if you waive out of UC SHIP. For information about this comprehensive plan, visit Student Health and Counseling Services.

Note: Only students who submitted the FAFSA/CADAA by the priority deadline will be eligible for Health Insurance Assistance. Your final amount will be determined after we have verified your eligibility.

Nonresident Supplemental Tuition

Includes fees and costs for attending summer and may be a combination of direct and indirect costs. This budget component applies to undergraduates, and will only be posted if applicable.

Other Costs

Includes additional basic educational cost considerations not categorized in the main budget components. This may comprise of but is not limited to, loan fees, the entering undergraduate document fee, or additional expenses approved through an appeal.

Indirect Costs

Housing and Food (off-campus/commuter)

Housing and Food includes housing, food, utilities, telephone, meals, and groceries while attending college, even if living at home with parents. The off-campus housing types for undergraduates are as follows:

Off-Campus Housing

For students who sign a lease and typically pay rent on a month-to-month basis directly to the leasing entity, this is an indirect cost. This includes students living physically on-campus who pay rent on a month-to-month basis. For example, Sol at West Village is physically on campus but is not considered On-Campus Housing for financial aid budget purposes as this location provides lease agreements to students who pay rent directly to the leasing entity on a month-to-month basis.

Commuter

A student who is living with a relative, usually a parent, is considered to be living at home. On the financial aid application, this is called Commuter. Your campus will use varying methods to confirm your living situation so that you are assigned the appropriate Cost of Attendance. This expense is an indirect cost.

Important: Students should ensure that MyAwards is displaying the correct housing status based on the information provided above. Students can view their housing status on the Summary tab by expanding the Total Estimated Cost of Attendance dropdown.

If a student's housing status is listed incorrectly, they can update Financial Aid and Scholarships with a Housing Status Change submission:

- Log in to MyAwards

- Click on the Awards tab

- Click the Submit Change in Aid request link

- Select Make changes to my housing status

- Select the correct Housing Status

- Submit

Once submitted, Financial Aid and Scholarships will update the student's budget within 7-10 business days.

Please note: The amount of grants and scholarships awarded are subject to change and may be prorated based on a student’s actual budget type, i.e., residence hall versus an off-campus apartment. Changes to qualifying information or revisions of federal, state, or institutional policy may result in updates to aid eligibility and adjustments of financial aid awards.

Books and Supplies

This is an indirect cost. It is an estimated average of the cost of books and school supplies (e.g., writing utensils, paper, computer purchase, etc.) while attending college. To keep costs down, students can participate in Equitable Access through the UC Davis bookstore, a flat-fee program that provides all undergraduate students with predictable costs for course materials.

Personal Expenses

This is an indirect cost. It is an estimated average of the cost of incidental expenses such as personal hygiene, laundry, clothing and reasonable entertainment.

Transportation

This is an indirect cost. It is an estimated average of transportation costs such as traveling to and from home on breaks, local transportation costs, etc., while attending college.

Understanding Your Costs

To better understand your out-of-pocket costs each term, use the Direct vs. Indirect Costs Worksheet.

Contributions

Self-Help

The amount that an undergraduate student may expect to contribute toward their education using a combination of loans, work options, scholarships, and/or summer savings.

Student Aid Index

An eligibility index that college financial aid staff use to determine how much financial aid you would receive if you were to attend their school. The Student Aid Index (SAI) is calculated according to a formula specified in law and is based upon the information provided by the student and their family on the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA) annually.

Additional Resources

Additional financial resources, such as fee waivers, outside scholarships, stipends, private loans, or a variety of other sources of funds. Some examples:

Gift Aid

Dollars awarded to the student that do not have to be paid back, unless the student fails to meet certain criteria, such as a service requirement that is specified as a condition of the gift aid or not completing the enrollment term for which the aid was awarded. Gift aid can include awards with titles such as grants, scholarships, remissions, awards, waivers, etc. Gift aid can be awarded based on many factors, including (but not limited to) financial need, academic excellence, athletic ability, musical and/or theatrical talent, affiliation with various groups, and/or career aspirations.

Grant

Gift aid that is typically based on financial need.

Scholarship

Gift aid that is typically based on merit, e.g., academic excellence, talent, career aspirations or affiliation with various groups, or on a combination of merit and need.

Work Option

A form of financial aid that does not need to be repaid, but must be earned through employment. It is an option provided to students to help them contribute to their cost of attendance. It may reduce their need to borrow.

Federal Work-Study

This is a work option offered and administered by the university that provides opportunities for part-time employment to students with financial need to help pay their educational expenses. Students are responsible for finding qualified employment using career services resources on campus. Funds are paid out through a paycheck, as earned.

Other Definitions

Disbursement

Payment of student aid funds to the student billing account by financial aid. These payments reduce the overall balance on the student account. If this results in more dollars on the account than on the bill, the student receives a refund.

Estimated Financial Aid

Estimated Financial Aid includes an estimation of the financial aid offer(s) for which a student is currently eligible. These may include grants, scholarships, fellowships, and/or loans. The estimation may include both need- and merit-based awards. The amount and types of funds offered may change if a student receives additional resources, their enrollment changes, or their eligibility changes as a result of the verification process. For an understanding of how aid will be paid during the academic year, students can view the Estimated Financial Aid by Term at the bottom of the summary page in MyAwards.

Enrollment Status

This is a student's academic workload (or course load) as defined by the university, in which a student is enrolled for a defined academic period. This normally relates to the number of credit hours taken by a student during a given academic period. This can include being enrolled full-time, three-quarter time, half time or less than half time; withdrawn; graduated, etc. The number of credits in which a student enrolls determines their enrollment status, which can affect financial aid award amounts.

Financial Need

Financial Need is your Cost of Attendance minus your Student Aid Index less any need-based aid received, such as gift aid, federal work-study, or federal subsidized loans.

Net Cost

Amount of direct and indirect costs remaining after all gift aid is applied. Net cost can be covered through a variety of sources, including savings, income, and education loans.

Non-California Residents

Non-California residents are eligible for federal financial aid based on their Free Application for Federal Student Aid (FAFSA), but state and university need-based funding is not available. Details can be found at Financial Aid Information for Non-California Residents.

Refund

Money given directly to the student from the university. This money comes from the student billing account having an excess credit balance. A credit balance is created when financial aid or payments made by the student, parent, or outside agency are more than the amount of the bill on the student account. A refund may be issued to a parent for federal Parent Loan payments if the parent has not granted permission for the excess money to go to the student.

Summer

Includes fees and costs for attending summer and may be a combination of direct and indirect costs. This budget component applies to undergraduates, and will only be posted if applicable.

Verification

A federally mandated process to confirm the accuracy of data provided by student applicants on the Free Application for Federal Student Aid (FAFSA). To complete the verification process, the student and, if applicable, their parent(s) or spouse is required to provide certain documents to the university for review. If the documentation the student provides to the university doesn't match what was reported on the FAFSA, verification can result in changes to the student's financial aid eligibility and/or to financial aid offers.

Waiver

A waiver is not paid in dollars through financial aid. It is a placeholder on the aid offer that represents the amount of fees that are waived on the student billing account by a different office. For example, Student Health may waive health insurance fees and the registrar may waive nonresident tuition for qualified students.